What should a cash flow forecast look like?

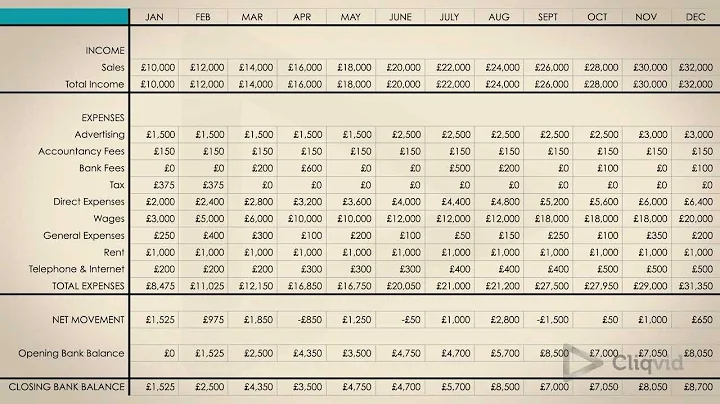

For each week or month in your cash flow forecast, list all the cash you've got coming in. Have one column for each week or month, and one row for each type of income. Start with your sales, adding them to the appropriate week or month. You might be able to predict this from previous years' figures, if you have them.

Positive cash flow indicates that a company's liquid assets are increasing, enabling it to cover obligations, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges.

The principle for the 12 month cash flow forecast is very simple: you compare the expected income with the expected expenditure for each month.

A projected 3-year cash flow is a financial statement that outlines the anticipated cash inflows and outflows for a business over a specific three-year timeframe. It takes into account factors such as sales revenue, expenses, investments, loan repayments, and other sources.

A healthy cash flow ratio is a higher ratio of cash inflows to cash outflows. There are various ratios to assess cash flow health, but one commonly used ratio is the operating cash flow ratio—cash flow from operations, divided by current liabilities.

The operating cash flow ratio represents a company's ability to pay its debts with its existing cash flows. It is determined by dividing operating cash flow by current liabilities. A ratio greater than 1.0 indicates that a company is in a strong position to pay its debts without incurring additional liabilities.

Disadvantages of cash flow forecasts

It can't predict the future of your business with absolute certainty. Nothing can do that. Just as a weather forecast becomes less accurate the further ahead it predicts, the same is true for cash flow forecasts. A lot can change, even in 12 months.

Examples of cash flow include: receiving payments from customers for goods or services, paying employees' wages, investing in new equipment or property, taking out a loan, and receiving dividends from investments.

A common benchmark used by real estate investors is to aim for a cash flow of at least 10% of the property's purchase price per year. For example, if a property is purchased for $200,000, the annual cash flow should be at least $20,000 ($1,667 per month).

In most companies, forecasts are collected on a weekly or one-month basis from business units. Forecasts can either be rolling or fixed term. A rolling cash flow forecast extends with each new submission, and a fixed-term forecast counts down to an end point, such as quarter or year-end.

How long should a cash flow forecast be?

1. Decide the period you want your cash flow forecast to cover + Cash flow planning can cover anything from a few weeks to many months. Plan at least as far ahead as your cash flow cycle lasts and try to be as accurate as possible.

Doing a cash flow forecast once may not give you a degree of accuracy that small business owners hope to achieve. One of the best ways to improve the accuracy of cash flow forecasts is to make it a habit. Updating your forecast as often as possible with new information can drastically improve its accuracy.

A cash flow forecast uses insights and analysis to anticipate how a business' cash flow will perform over time. A cash flow statement is a type of financial statement that shows how much money and cash equivalents a company has on hand.

One of the main difference between a budget and estimates in a cash flow forecast is the time period they cover. A budget covers a year or longer and focuses on income and expenses, while a cash flow forecast (generally) covers a shorter period and focuses on the timing of cash inflows and outflows.

When it comes to cash-flow management, one general rule of thumb suggests enough to cover three to six months' worth of operating expenses. However, true cash management success could require understanding when it might be beneficial to invest some cash elsewhere as well.

- Monitor your cash flow closely. ...

- Make projections frequently. ...

- Identify issues early. ...

- Understand basic accounting. ...

- Have an emergency backup plan. ...

- Grow carefully. ...

- Invoice quickly. ...

- Use technology wisely and effectively.

So, is cash flow the same as profit? No, there are stark differences between the two metrics. Cash flow is the money that flows in and out of your business throughout a given period, while profit is whatever remains from your revenue after costs are deducted.

One can conduct a basic cash flow analysis by examining the cash flow statement, determining whether there is net negative or positive cash flow, pinpointing how the outflows compare to inflows, and draw conclusions from that.

Cash flow indicators typically found on a dashboard include: Actual sales and sales in your pipeline. Average days collection (for your accounts receivable) and average days payable outstanding (to your suppliers) Inventory outstanding.

If a company's cash ratio is less than 1, there are more current liabilities than cash and cash equivalents. It means insufficient cash on hand exists to pay off short-term debt.

Why is cash flow forecasting not important?

It doesn't account for unforeseen circ*mstances

A business functions in a dynamic, uncontrollable environment and any number of unforeseen external factors could impact the cash flow forecast.

Without forecasting a company's cashflow, it would be almost impossible to estimate how much cash your company will have at a given time.

Cash flow forecasting is important because it enables businesses to make informed strategic decisions by having an accurate picture of what their cash position looks like in the future.

There are three cash flow types that companies should track and analyze to determine the liquidity and solvency of the business: cash flow from operating activities, cash flow from investing activities and cash flow from financing activities. All three are included on a company's cash flow statement.

A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. The CFS highlights a company's cash management, including how well it generates cash. This financial statement complements the balance sheet and the income statement.

References

- https://www.quora.com/What-is-the-difference-between-DCF-and-FCF

- https://www.highradius.com/resources/Blog/how-are-cash-flow-forecasts-different-from-cash-flow-statements/

- https://bookkeepingforsmallbusinessess.quora.com/What-is-the-difference-between-discounted-cash-flow-and-actual-revenue-cash-flows

- https://www.investopedia.com/investing/what-is-a-cash-flow-statement/

- https://online.hbs.edu/blog/post/how-to-read-a-cash-flow-statement

- https://cashanalytics.com/cash-flow-forecasting/

- https://www.venasolutions.com/blog/discounted-cash-flow-model-explained

- https://www.indeed.com/career-advice/career-development/cash-flow-projection-statement

- https://valutico.com/discounted-cash-flow-analysis-your-complete-guide-with-examples/

- https://dealroom.net/faq/valuation-methods

- https://www.cuemath.com/commercial-math/discounts/

- https://stablebread.com/how-to-value-a-company-using-the-discounted-cash-flow-model/

- https://www.caplinked.com/blog/understanding-discounted-cash-flow-valuation-models/

- https://countingtheapples.com/advantages-and-disadvantages-of-a-cash-flow-forecast/

- https://www.investopedia.com/terms/d/dcf.asp

- https://corporatefinanceinstitute.com/resources/valuation/dcf-pros-and-cons/

- https://www.wallstreetprep.com/knowledge/dcf-model-training-6-steps-building-dcf-model-excel/

- https://blog.bqe.com/cash-flow-projection-why-its-important-for-your-firm

- https://www.investopedia.com/articles/personal-finance/061215/10-ways-improve-cash-flow.asp

- https://gocardless.com/guides/posts/what-is-cash-flow-forecasting/

- https://www.smartsheet.com/content/discounted-cash-flow-pros-cons

- https://www.investopedia.com/articles/stocks/08/discounted-cash-flow-valuation.asp

- https://www.waveapps.com/blog/cash-flow-formula

- https://www.investopedia.com/terms/c/cashflow.asp

- https://quizlet.com/160009675/discounted-cash-flow-valuationmodeling-flash-cards/

- https://www.stessa.com/blog/discounted-cash-flow/

- https://nanonets.com/blog/discounted-cash-flow/

- https://agicap.com/en/article/cash-flow-projection-template/

- https://www.forentrepreneurs.com/discount-rate-for-dcf/

- https://taulia.com/glossary/what-is-cash-flow-forecasting/

- https://finmark.com/cash-flow-projection/

- https://www.cashanalytics.com/what-is-cash-flow-forecasting/

- https://www.quora.com/Why-is-it-difficult-to-measure-future-cash-flows

- https://www.british-business-bank.co.uk/business-guidance/guidance-articles/finance/what-is-cash-flow-how-do-you-manage-it

- https://www.universalfunding.com/poor-cash-flow/

- https://www.investopedia.com/terms/c/cash-flow-from-operating-activities.asp

- https://www.linkedin.com/pulse/pros-cons-discounted-cash-flow-dcf-valuations-financial-nick-nemeth

- https://www.investopedia.com/terms/i/irr.asp

- https://www.linkedin.com/advice/0/what-discounted-cash-flow-analysis-how-can-help-iuqmf

- https://floatapp.com/blog/7-advantages-of-cash-flow-forecast/

- https://www.investopedia.com/terms/n/npv.asp

- https://www.highradius.com/resources/Blog/tips-to-solve-problems-of-cash-management/

- https://takethehelm.app/blog/whats-the-difference-between-a-budget-and-a-cash-flow-forecast/

- https://quizlet.com/18075601/discounted-cash-flow-flash-cards/

- https://www.thehartford.com/business-insurance/strategy/manage-cash-flow/best-practices

- https://www.linkedin.com/advice/0/what-advantages-disadvantages-using-multiples-1c

- https://www.investopedia.com/investing/pitfalls-of-discounted-cash-flow-analysis/

- https://www.linkedin.com/pulse/private-equity-valuation-methods-ayyappa-ch

- https://equitest.net/how-to-calculate-discounted-cash-flows-for-quarterly-or-monthly-periods.html

- https://groww.in/p/discounted-cash-flow

- https://tipalti.com/accounting-hub/discounted-cash-flow/

- https://cbpbu.ac.in/userfiles/file/2020/STUDY_MAT/COMMERCE/COM%20203%20(FM)_CAPITAL%20BUDGETING%20TECHNIQUES%20(2)-converted.pdf

- https://www.dcfdefense.com/connecticut-dcf-investigation-defense-lawyer/length/

- https://learn.liferay.com/w/commerce/pricing/promoting-products/using-discount-levels

- https://agicap.com/en/article/cash-flow-forecast-advantages/

- https://www.hiltonbairdcollections.co.uk/reasons-cash-flow-forecast-never-accurate/

- https://gtreasury.com/blog/7-cash-flow-forecasting-challenges/

- https://www.wallstreetprep.com/knowledge/dcf-pros-cons/

- https://www.americanexpress.com/en-us/business/trends-and-insights/articles/cash-flow-management-how-much-cash-should-you-keep-in-your-business/

- https://corporatefinanceinstitute.com/resources/valuation/dcf-formula-guide/

- https://www.pnc.com/insights/small-business/manage-business-finances/biggest-causes-of-cash-flow-problems.html

- https://blog.wisesheets.io/dcf-assumptions-explained-secrets-to-accurate-intrinsic-value/

- https://www.investopedia.com/articles/stocks/07/easycashflow.asp

- https://en.wikipedia.org/wiki/Discounted_cash_flow

- https://www.velotrade.com/blog/most-common-cash-flow-problems/

- https://www.equiruswealth.com/glossary/cash-flow-statement

- https://smallbusiness.chron.com/problems-can-arise-cash-flow-analysis-68659.html

- https://www.swrecovery.com/resources/blog/8-businesses-that-suffer-cash-flow-problems-is-yours-one/

- https://www.investopedia.com/articles/financial-theory/11/corporate-project-valuation-methods.asp

- https://www.nomentia.com/blog/cash-flow-forecasting

- https://www.coursehero.com/file/p536ms1d/4-Why-would-you-not-use-a-DCF-for-a-bank-or-other-financial-institution-Banks/

- https://pages.stern.nyu.edu/~adamodar/New_Home_Page/problems/dcfprob.htm

- https://braccounting.co.uk/journal/top-seven-tips-for-accurate-cash-flow-forecasting.html

- https://www.business.qld.gov.au/running-business/finance/improve-performance/cash-flow

- https://agicap.com/en/article/cash-flow-forecast-limitations/

- https://www.americanexpress.com/en-gb/business/trends-and-insights/articles/why-is-cash-flow-important/

- https://www.bdc.ca/en/articles-tools/money-finance/manage-finances/track-cash-flow-with-simple-dashboard

- https://www.sumup.com/en-gb/invoices/invoicing-essentials/6-ways-to-improve-cash-flow-in-your-business/

- https://www.datarails.com/finance-glossary/discounted-cash-flow/

- https://finmark.com/direct-vs-indirect-cash-flow/

- https://www.bill.com/blog/tips-to-maintain-a-healthy-cash-flow

- https://nowcorp.com/cash-flow-estimation/

- https://honeycombinsurance.com/insurance-learning-center/average-cash-flow-on-rental-property/

- https://www.shopify.com/ph/blog/cash-flow-statement

- https://www.firmex.com/resources/blog/discounted-cash-flow-valuation-advantages-pitfalls/

- https://www.highradius.com/resources/Blog/cash-flow-projection-guide/

- https://www.datarails.com/finance-glossary/internal-rate-of-return/

- https://happay.com/blog/cash-flow-forecasting/

- https://link.springer.com/article/10.1007/s12630-010-9304-6

- https://corporatefinanceinstitute.com/resources/financial-modeling/discount-factor/

- https://www.unomaha.edu/nebraska-business-development-center/_files/publications/cash-flow.pdf

- https://www.graduatetutor.com/corporate-finance-tutoring/cash-flow/how-do-interest-rates-factor-in-dcf-valuation/

- https://www.investopedia.com/terms/o/operatingcashflow.asp

- https://www.waveapps.com/blog/cash-flow-projection

- https://www.patriotsoftware.com/blog/accounting/what-is-a-cash-flow-statement-example/

- https://pitchbook.com/blog/how-discounted-cashflow-analysis-works

- https://www.investopedia.com/ask/answers/111714/whats-more-important-cash-flow-or-profits.asp

- https://corporatefinanceinstitute.com/resources/valuation/discounted-cash-flow-dcf/

- https://gocardless.com/en-us/guides/posts/cash-flow-vs-profit/

- https://www.aabrs.com/company-has-cash-flow-problems/

- https://www.shopify.com/blog/positive-cash-flow

- https://www.theforage.com/blog/skills/dcf-valuation

- https://agicap.com/en/article/12-month-cash-flow-forecast-explained/

- https://www.investopedia.com/articles/professionals/072915/dcf-vs-comparables-which-one-use.asp

- https://www.british-business-bank.co.uk/finance-hub/how-to-create-a-cash-flow-forecast-in-4-steps/

- https://www.vedantu.com/commerce/cash-flow-statement

- https://www.netsuite.com/portal/resource/articles/financial-management/cash-flow-analysis.shtml

- https://www.linkedin.com/advice/3/how-can-you-ensure-cash-flow-statement-accuracy

- https://www.investopedia.com/terms/c/cash-ratio.asp

- https://strategiccfo.com/articles/cashflow/discounted-cash-flow-analysis/

- https://www.menzies.co.uk/the-importance-of-cashflow-forecasting/