How reliable are cash flow forecasts?

Cash Flow Forecasting Mistakes

Doing a cash flow forecast once may not give you a degree of accuracy that small business owners hope to achieve. One of the best ways to improve the accuracy of cash flow forecasts is to make it a habit. Updating your forecast as often as possible with new information can drastically improve its accuracy.

Dependency on limited and historical information. To prepare cash flow forecasts, accountants rely on the information they can gather from internal and external sources. However, access to limited information often leads to inaccurate cash flow forecasts. Additionally, they rely on historical data to predict the future ...

Drawbacks. The limitations of cash flow forecasts include being unable to account for changing costs, and the accuracy of when money comes into the business. Miscalculations will affect the business which could result in debt.

For cash flow forecasting to be as accurate as possible, your financial forecasting needs to be updated every time something changes that will impact your cash flow. For example, two situations that will significantly affect your cash flow forecast include late payments and increased sales.

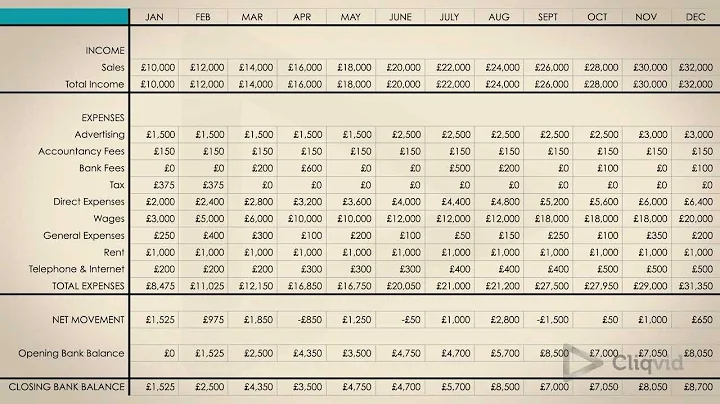

- Forecast your income or sales. First, decide on a period that you want to forecast. ...

- Estimate cash inflows. ...

- Estimate cash outflows and expenses. ...

- Compile the estimates into your cash flow forecast. ...

- Review your estimated cash flows against the actual.

As a cash flow statement is based on a cash basis of accounting, it ignores the basic accounting concept of accrual. Cash flow statements are not suitable for judging the profitability of a firm, as non-cash charges are ignored while calculating cash flows from operating activities.

Without forecasting a company's cashflow, it would be almost impossible to estimate how much cash your company will have at a given time.

Yes, a profitable company can have negative cash flow. Negative cash flow is not necessarily a bad thing, as long as it's not chronic or long-term. A single quarter of negative cash flow may mean an unusual expense or a delay in receipts for that period. Or, it could mean an investment in the company's future growth.

Direct forecasting provides the greatest accuracy and works for the majority of business objectives that companies build forecasts to support. Therefore, we'll focus on where to find actual cash flow data for your forecast in this section.

How often should you do a cash flow forecast?

In most companies, forecasts are collected on a weekly or one-month basis from business units. Forecasts can either be rolling or fixed term. A rolling cash flow forecast extends with each new submission, and a fixed-term forecast counts down to an end point, such as quarter or year-end.

Cash flow forecasting, also known as cash forecasting, estimates the expected flow of cash coming in and out of your business, across all areas, over a given period of time. A short-term cash forecast may cover the next 30 days and can be used to identify any funding needs or excess cash in the immediate term.

Planning for the future, assessing future performance, predicting future goal accomplishments, and identifying cash shortages are the uses of a cash flow forecast.

- Under-committing. Cash flow forecasting is one of the most important business management tools. ...

- Inaccurate data. ...

- Lack of communication. ...

- Not considering different scenarios. ...

- Late loans.

One of the most common errors that businesses make in their cash flow statements is misclassifying how cash is actually flowing through their business. This results in a lot of confusion about where the cash is actually going, which can disrupt the actual cash flow of the business.

Both finance and treasury teams are primarily responsible for forecasting cash flows. They collect all required data from different business stakeholders and a variety of financial and other systems and combine them to run analyses on future cash positions at certain given times.

Inaccurate cash forecasting leads to poor advice on business decisions, which can cost your company a lot of money. Unable to identify cash shortfalls, your company may run out of liquidity and go bankrupt.

Does Quickbooks offer cash flow forecasting? Yes. The cash flow planner uses your bank and QuickBooks activity to forecast money-in and money-out 30 and 90 days ahead. Know where business is going so you can budget wisely.

What is a Company Cash Flow Problem? A cash flow problem occurs when the amount of money flowing out of the company outweighs the cash coming in. This causes a lack of liquidity, which can inhibit your ability to make payments to suppliers, repay loans, pay your bills and run the business effectively.

A cash flow forecast uses insights and analysis to anticipate how a business' cash flow will perform over time. A cash flow statement is a type of financial statement that shows how much money and cash equivalents a company has on hand.

Does cash flow affect balance sheet?

The cash flow statement is linked to the balance sheet because the financial statement tracks the change in the working capital accounts, i.e. the increase or decrease in working capital. The impact of capital expenditures – i.e. the purchase of PP&E – is also reflected on the cash flow statement.

Cash flow forecasting enables a business owner to differentiate between two valuable financial metrics – profit and cash flow. Knowledge of their current and future cash position is essential for any business owner to know how much cash is available in the bank at any one time, under any given scenario.

One of the main reasons businesses forecast cash is because it allows them to predict future cash positions. Having an understanding of what your cash flow may look like in the near future will allow you to prepare yourself for what may come and to plan your next moves.

- Risk from Operating Activities. ...

- Risk from Investing Activities. ...

- Risk from Financing Activities. ...

- Risk from Free Cash Flow. ...

- High Expenditure Compared to Sales. ...

- Low Sales. ...

- Bad Receivable Collection and Bad Debts. ...

- Bad Pricing and Negative Gross Margins.

Question: How long can a company's cash flows continue? Indefinitely, provided the company survives Until it meets its debt obligations Only for a few years.

References

- https://learn.saylor.org/mod/book/view.php?id=53789&chapterid=37980

- https://finmark.com/cash-flow-projection/

- https://www.quora.com/Why-is-it-difficult-to-measure-future-cash-flows

- https://www.investopedia.com/investing/pitfalls-of-discounted-cash-flow-analysis/

- https://www.netsuite.com/portal/resource/articles/financial-management/cash-flow-analysis.shtml

- https://www.vedantu.com/commerce/cash-flow-statement

- https://www.nomentia.com/blog/cash-flow-forecasting

- https://www.investopedia.com/ask/answers/050415/how-should-i-evaluate-company-negative-cash-flow-investing-activities.asp

- https://www.investopedia.com/terms/c/cashflow.asp

- https://www.linkedin.com/advice/0/what-discounted-cash-flow-analysis-how-can-help-iuqmf

- https://www.highradius.com/resources/Blog/cash-flow-projection-guide/

- https://www.coursehero.com/file/p536ms1d/4-Why-would-you-not-use-a-DCF-for-a-bank-or-other-financial-institution-Banks/

- https://www.cashanalytics.com/what-is-cash-flow-forecasting/

- https://www.thehartford.com/business-insurance/strategy/manage-cash-flow/best-practices

- https://www.aabrs.com/company-has-cash-flow-problems/

- https://taulia.com/glossary/what-is-cash-flow-forecasting/

- https://www.firmex.com/resources/blog/discounted-cash-flow-valuation-advantages-pitfalls/

- https://dealroom.net/faq/valuation-methods

- https://braccounting.co.uk/journal/top-seven-tips-for-accurate-cash-flow-forecasting.html

- https://www.shopify.com/blog/positive-cash-flow

- https://www.sumup.com/en-gb/invoices/invoicing-essentials/6-ways-to-improve-cash-flow-in-your-business/

- https://groww.in/p/discounted-cash-flow

- https://www.investopedia.com/terms/c/cash-ratio.asp

- https://link.springer.com/article/10.1007/s12630-010-9304-6

- https://valutico.com/discounted-cash-flow-analysis-your-complete-guide-with-examples/

- https://quickbooks.intuit.com/ca/cash-flow/

- https://nowcorp.com/cash-flow-estimation/

- https://www.smartsheet.com/content/discounted-cash-flow-pros-cons

- https://www.unomaha.edu/nebraska-business-development-center/_files/publications/cash-flow.pdf

- https://gocardless.com/guides/posts/what-is-cash-flow-forecasting/

- https://www.menzies.co.uk/the-importance-of-cashflow-forecasting/

- https://www.british-business-bank.co.uk/business-guidance/guidance-articles/finance/what-is-cash-flow-how-do-you-manage-it

- https://www.investopedia.com/terms/n/npv.asp

- https://honeycombinsurance.com/insurance-learning-center/average-cash-flow-on-rental-property/

- https://www.pnc.com/insights/small-business/manage-business-finances/biggest-causes-of-cash-flow-problems.html

- https://www.bdc.ca/en/articles-tools/money-finance/manage-finances/track-cash-flow-with-simple-dashboard

- https://agicap.com/en/article/cash-flow-projection-template/

- https://quizlet.com/160009675/discounted-cash-flow-valuationmodeling-flash-cards/

- https://www.investopedia.com/ask/answers/111714/whats-more-important-cash-flow-or-profits.asp

- https://www.venasolutions.com/blog/discounted-cash-flow-model-explained

- https://cbpbu.ac.in/userfiles/file/2020/STUDY_MAT/COMMERCE/COM%20203%20(FM)_CAPITAL%20BUDGETING%20TECHNIQUES%20(2)-converted.pdf

- https://cashflowfrog.com/blog/best-benefits-of-a-precise-cash-flow-forecast/

- https://corporatefinanceinstitute.com/resources/valuation/dcf-pros-and-cons/

- https://www.linkedin.com/pulse/pros-cons-discounted-cash-flow-dcf-valuations-financial-nick-nemeth

- https://countingtheapples.com/advantages-and-disadvantages-of-a-cash-flow-forecast/

- https://learn.liferay.com/w/commerce/pricing/promoting-products/using-discount-levels

- https://cashanalytics.com/cash-flow-forecasting/

- https://www.velotrade.com/blog/most-common-cash-flow-problems/

- https://altline.sobanco.com/cash-flow-risk-management-and-how-to-reduce-risk/

- https://www.bill.com/blog/tips-to-maintain-a-healthy-cash-flow

- https://www.investopedia.com/articles/personal-finance/061215/10-ways-improve-cash-flow.asp

- https://www.investopedia.com/articles/stocks/07/easycashflow.asp

- https://business.vic.gov.au/business-information/finance/cash-flow/cash-flow-forecasting

- https://www.british-business-bank.co.uk/finance-hub/how-to-create-a-cash-flow-forecast-in-4-steps/

- https://www.shopify.com/ph/blog/cash-flow-statement

- https://www.wallstreetprep.com/knowledge/how-are-the-three-financial-statements-linked/

- https://www.wallstreetprep.com/knowledge/dcf-pros-cons/

- https://floatapp.com/blog/7-advantages-of-cash-flow-forecast/

- https://www.studysmarter.co.uk/explanations/business-studies/financial-performance/cash-flow-forecast/

- https://www.highradius.com/resources/Blog/how-are-cash-flow-forecasts-different-from-cash-flow-statements/

- https://www.myfirm360.com/blog/errors-cash-flow-statements-avoid

- https://iongroup.com/blog/treasury/10-ways-an-inaccurate-cash-forecast-can-hurt-your-business/

- https://agicap.com/en/article/cash-flow-forecast-limitations/

- https://www.investopedia.com/articles/professionals/072915/dcf-vs-comparables-which-one-use.asp

- https://pitchbook.com/blog/how-discounted-cashflow-analysis-works

- https://gocardless.com/en-us/guides/posts/cash-flow-vs-profit/

- https://www.business.qld.gov.au/running-business/finance/improve-performance/cash-flow

- https://gtreasury.com/blog/7-cash-flow-forecasting-challenges/

- https://happay.com/blog/cash-flow-forecasting/

- https://www.waveapps.com/blog/cash-flow-projection

- https://www.americanexpress.com/en-gb/business/trends-and-insights/articles/why-is-cash-flow-important/

- https://agicap.com/en/article/cash-flow-forecast-advantages/

- https://corporatefinanceinstitute.com/resources/financial-modeling/discount-factor/

- https://corporatefinanceinstitute.com/resources/valuation/discounted-cash-flow-dcf/

- https://takethehelm.app/blog/whats-the-difference-between-a-budget-and-a-cash-flow-forecast/

- https://www.waveapps.com/blog/cash-flow-formula

- https://www.universalfunding.com/poor-cash-flow/

- https://www.cuemath.com/commercial-math/discounts/

- https://corporatefinanceinstitute.com/resources/valuation/dcf-formula-guide/

- https://www.stessa.com/blog/discounted-cash-flow/

- https://finmark.com/direct-vs-indirect-cash-flow/

- https://blog.wisesheets.io/dcf-assumptions-explained-secrets-to-accurate-intrinsic-value/

- https://www.investopedia.com/articles/financial-theory/11/corporate-project-valuation-methods.asp

- https://www.linkedin.com/advice/0/what-advantages-disadvantages-using-multiples-1c

- https://www.theforage.com/blog/skills/dcf-valuation

- https://www.highradius.com/resources/Blog/tips-to-solve-problems-of-cash-management/

- https://www.investopedia.com/terms/c/cash-flow-from-operating-activities.asp

- https://www.chegg.com/homework-help/questions-and-answers/long-company-s-cash-flows-continue-indefinitely-provided-company-survives-meets-debt-oblig-q124751390

- https://equitest.net/how-to-calculate-discounted-cash-flows-for-quarterly-or-monthly-periods.html

- https://www.equiruswealth.com/glossary/cash-flow-statement

- https://smallbusiness.chron.com/problems-can-arise-cash-flow-analysis-68659.html

- https://www.quora.com/What-is-the-difference-between-DCF-and-FCF

- https://quizlet.com/18075601/discounted-cash-flow-flash-cards/

- https://www.indeed.com/career-advice/career-development/cash-flow-projection-statement

- https://www.investopedia.com/terms/o/operatingcashflow.asp

- https://blog.mycorporation.com/2017/10/5-cash-flow-forecasting-mistakes-businesses-make/

- https://www.americanexpress.com/en-us/business/trends-and-insights/articles/cash-flow-management-how-much-cash-should-you-keep-in-your-business/

- https://agicap.com/en/article/12-month-cash-flow-forecast-explained/

- https://stablebread.com/how-to-value-a-company-using-the-discounted-cash-flow-model/

- https://pages.stern.nyu.edu/~adamodar/New_Home_Page/problems/dcfprob.htm

- https://online.hbs.edu/blog/post/how-to-read-a-cash-flow-statement

- https://www.hiltonbairdcollections.co.uk/reasons-cash-flow-forecast-never-accurate/

- https://tipalti.com/accounting-hub/discounted-cash-flow/

- https://www.investopedia.com/investing/what-is-a-cash-flow-statement/

- https://www.linkedin.com/advice/3/how-can-you-ensure-cash-flow-statement-accuracy

- https://www.wallstreetprep.com/knowledge/dcf-model-training-6-steps-building-dcf-model-excel/

- https://www.caplinked.com/blog/understanding-discounted-cash-flow-valuation-models/

- https://blog.bqe.com/cash-flow-projection-why-its-important-for-your-firm

- https://www.patriotsoftware.com/blog/accounting/what-is-a-cash-flow-statement-example/

- https://www.datarails.com/finance-glossary/discounted-cash-flow/

- https://www.swrecovery.com/resources/blog/8-businesses-that-suffer-cash-flow-problems-is-yours-one/